UBS Dividend Builders

Hypothetical Examples

The following hypothetical examples are used for illustrative purposes only and actual underlying share price performance, Dividends and Interest Amounts may be significantly different to what is shown here.

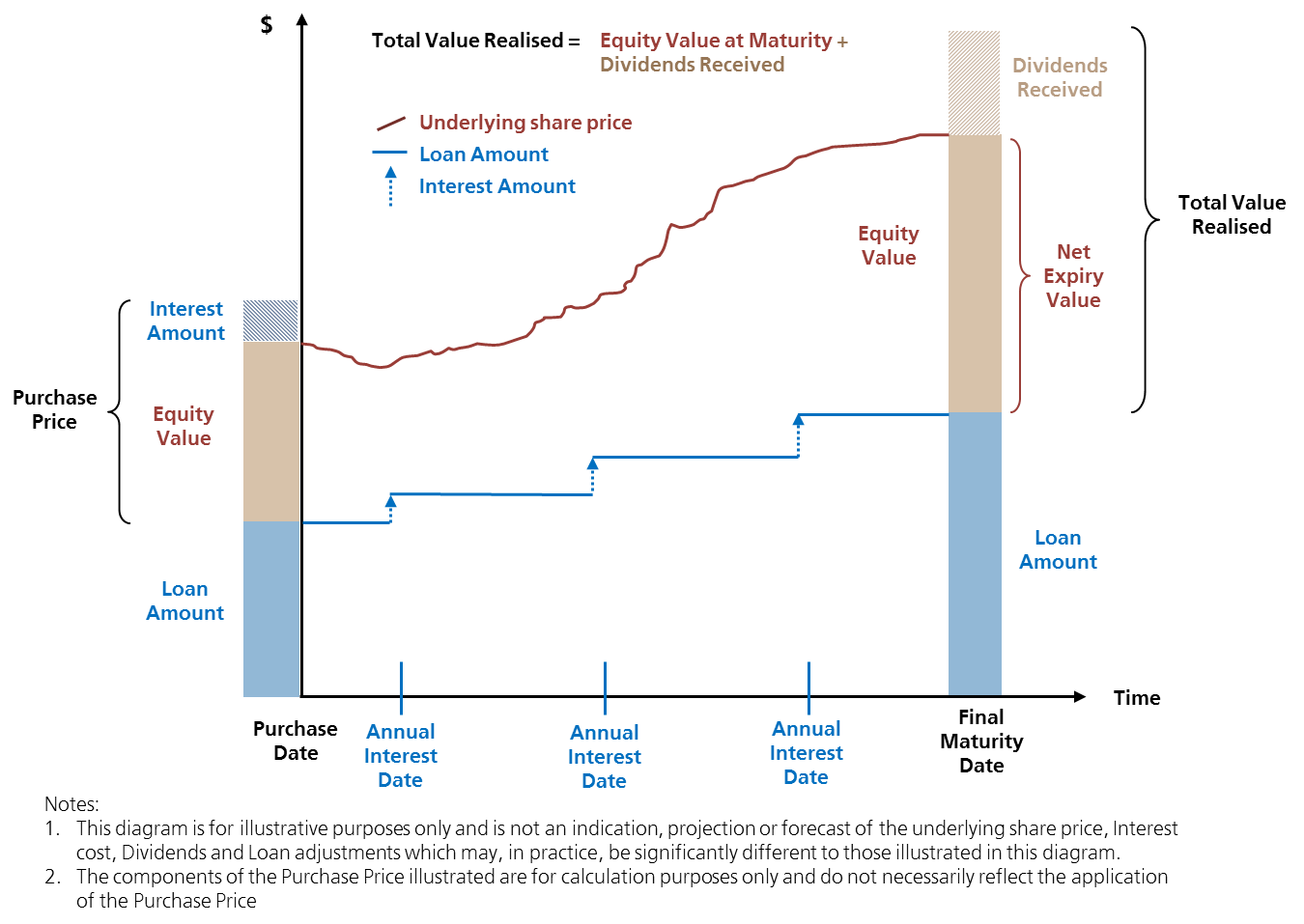

Hypothetical Example 1 - UBS Dividend Builder - positive performance

- Interest Rate is the same as or less than expected and the underlying share price appreciates by more than the sum of the Interest Amounts

- Dividend income forms part of total investment return

- Percentage increase in Equity Value exceeds the percentage increase in the underlying share price over the same period due to the effect of leverage

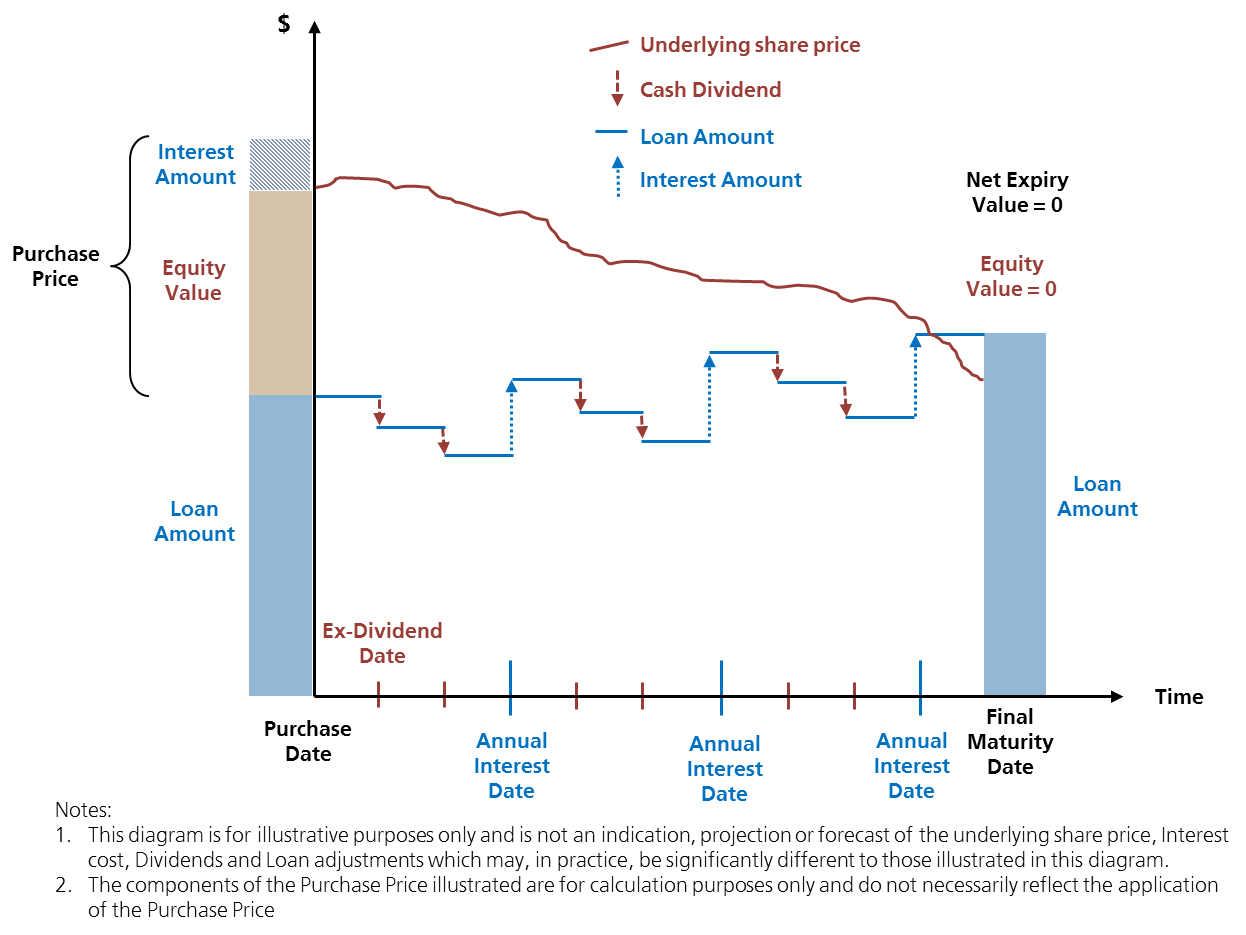

Hypothetical Example 2 - UBS Dividend Builder - negative performance

- Interest Rate is higher than expected and the underlying share price depreciates

- Dividend income, whilst forming part of total return, is less than total Interest paid

- underlying share price is less than the Loan Amount at Maturity (i.e. Net Expiry Value and Equity Value are zero)

- Zero Equity Value means the Holder has lost the entire amount invested, but unlike full recourse loans the Walkaway Feature means the Holder does not have to repay the Loan out of their own money

-

Quicklinks