UBS Share Builders

Strategies

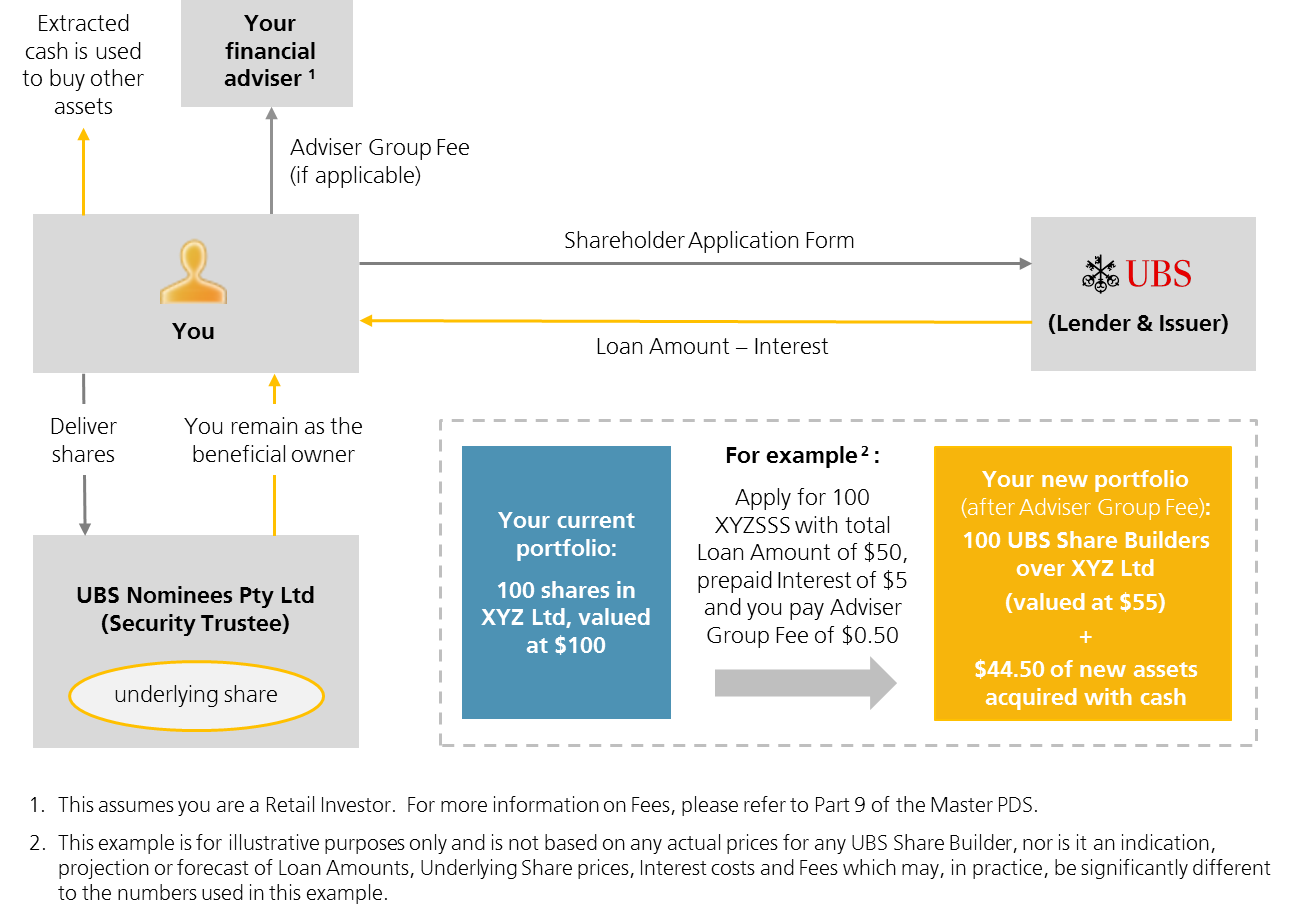

Cash Extraction - One step to unlock equity in your shares

If you currently hold shares and you do not want to sell them to generate cash for other investments, you can obtain a Loan from UBS by converting your shares into UBS Share Builders issued over that underlying share.

By using the value of your existing shares as collateral, you can use the funds provided under the Loan to make other investments whilst retaining beneficial ownership of the shares. This means there should be no taxable disposal1 of your shares and you will retain your entitlement to dividends and potential franking credits (if you meet the ATO's eligibility criteria).

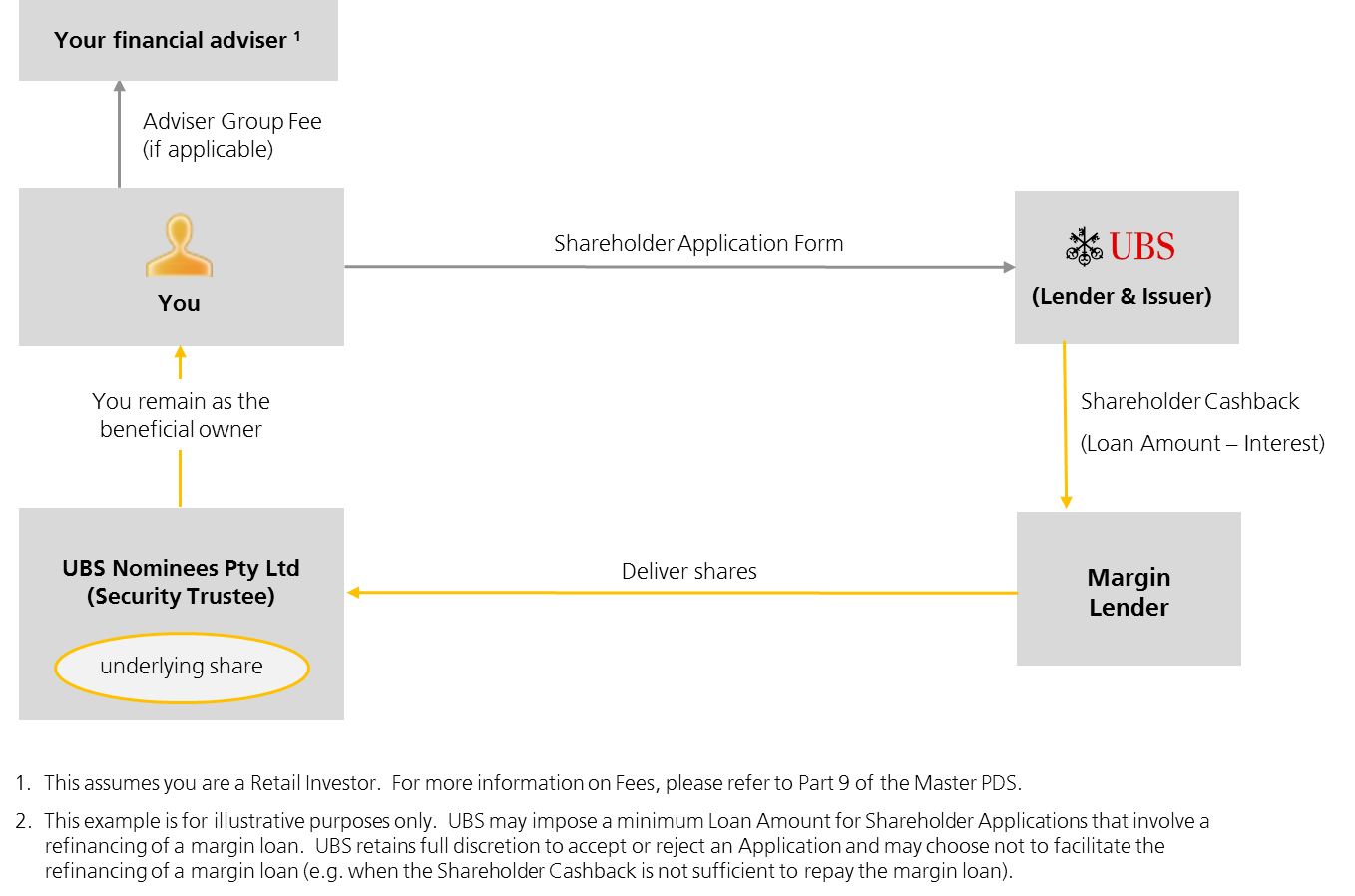

If your shares are currently held subject to a full recourse margin loan then you can refinance your margin loan using UBS Share Builders and convert your loan from a full recourse loan to a limited recourse loan. You can do this by making a Shareholder Application and directing UBS to apply the Shareholder Cashback to repay your margin loan. In return, the Underlying Shares released from the margin loan must be delivered to UBS to be held as security for the Loan under the UBS Share Builders. Whilst legal title to the shares will change during this process, you will retain beneficial ownership so there should be no taxable disposal2 of your shares.

Leverage - A supplement for your investment strategy

You may be considering ways to potentially accelerate your wealth creation through borrowing to increase your exposure to shares.

There are many choices when considering borrowing to invest in the share market, with the more commons ones being:

- borrowing against other assets, such as a full recourse loan against your home or other assets

- margin lending, with full recourse to the shares you purchase and your other personal assets and the need to meet margin calls

- UBS Share Builders, with limited recourse only to the shares you purchase with the Loan

If you want to limit the lender's recourse to the shares that you buy with the Loan, then UBS Share Builders could be a valid alternative because UBS has no recourse to your other assets for repayment of the Loan and there are no margin calls.

You can buy UBS Share Builders on the ASX by selecting the underlying share you want to invest in, the total value of underlying shares you want exposure to and the Loan Amount per underlying share that is closest to the amount you would like to borrow.

Example

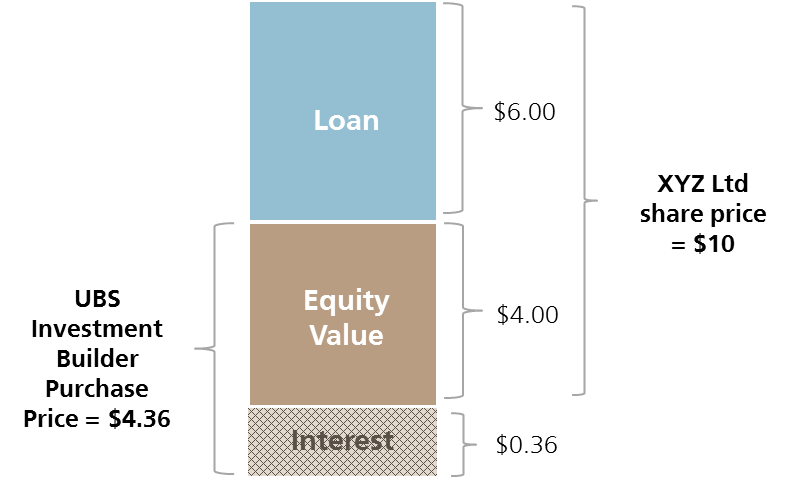

Assume XYZ Ltd share is trading at $10 per share. You would like to have exposure to $20,000 worth of XYZ Ltd for a period of approximately 9 months. If you were to outlay only your own funds to buy the shares you would pay $20,000 for 2,000 XYZ Ltd shares.

Assume the XYZSSA Series of UBS Share Builders over XYZ Ltd has a Loan Amount of $6 per XYZ Ltd share and a term to the next Annual Interest Date of 9 months. Assume also that the Interest Rate quoted by UBS for XYZSSA is currently 8% p.a.

This means the Interest Amount payable as part of the Purchase Price of XYZSSA is equal to $6 x 8% x 9 ÷ 12 = $0.36.

Since UBS is providing you with a Loan of $6 per XYZ Ltd share under the XYZSSA Series, you only need to contribute $4 of your own cash to buy the XYZ Ltd shares which are trading at $10 each.

This means that the Purchase Price of XYZSSA is $4 + $0.36 = $4.36 each. To gain exposure to 2,000 XYZ Ltd shares you would therefore pay $4.36 x 2,000 = $8,720. Alternatively, for the same upfront payment of $20,000 you can acquire 4,587 XYZSSA.

By automatically getting access to borrowed funds when you buy a UBS Share Builder, you can reduce the amount that you have to contribute yourself, or increase your investment exposure for the same cash outlay.

** Please note this is a hypothetical example provided for illustrative purposes only. It is not based on actual data relating to a particular underlying share or a particular UBS Share Builder. The assumptions used should not be relied upon as a forecast of future performance of any underlying share or UBS Share Builder, which may be very different to this example.

1See "Taxation Summary" in Part 8 of the Master PDS for more information.

2See "Taxation Summary" in Part 8 of the Master PDS for more information.

-

Quicklinks